Matty’s Minute: A November Market Update

Greetings:

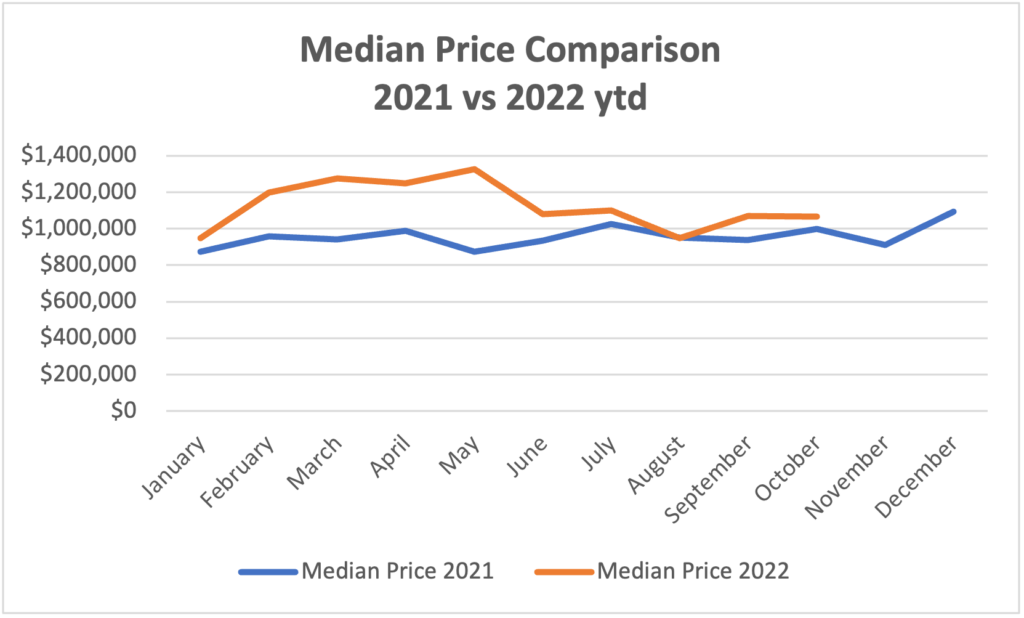

In stark contrast to prevailing assumptions, values for real estate in the Tahoe Truckee region rose in October. While the quantity of transactions has declined market wide, certain communities wherein supply remains constrained are seeing resolute pricing stability.

In October, a meaningful number of premium properties transacted demonstrating continued demand for quality homes. Martis Camp posted three sales between $7,000,000 and $12,000,000, the latter representing the 11th transaction to surpass $10 million within that community in 2022. Olympic Valley, Lahontan, Northstar Mountainside and certain lakeside communities also posted transactions well above $3 million. As well, certain market niches that often are among the first to languish in a transitioning market, namely unconventional homes on larger acreage properties, also showed movement. All of which demonstrates demand for quality offerings remains intact despite the froth having come off the market.

Notable within the current market dynamic is that of the 90 residential closings in October, nearly 60% required a price reduction from the original listing price before going into contract. Once a list price was determined to be reasonable, these transactions closed at an average of 3% below the ask. Given an 8% spread between original list price and final sales price, yet general price stability, the perception of a falling market would seem to lie with sellers overly ambitions in their asking prices rather than meaningful erosion of values.

Given the vast geographic span of the Tahoe Truckee area, assigning market wide data trends to specific homes may send false signals. However, the chart below demonstrates that until a market reaches 6 months of inventory, price will not falter.

Current supply stands at just 338 residential properties, less than 3 months of inventory at current rates of absorption.

Actual performance is far more localized in that certain market segments have much greater sensitivity to factors including interest rates, fire insurance limitations and short-term rental ordinances.

While no community is overloaded with listings to the point of concern, a quick scan shows where supply is most ample:

Given the exceptionally high usage of most homes, primary and secondary (or a hybrid thereof), as well as the distinct absence of distress for reasons to do with mortgage carry or equity, it is unlikely that the local market experiences a meaningful flood of inventory before Spring, 2023.

With snow in the immediate forecast and ski resorts planning to open within weeks, a small push of holiday-thinking consumers may be active in the coming weeks before plunging into a typical holiday malaise. Given the factors detailed above, Q1 is setting up to be relatively quiet for total transactions while mostly stable for values.